One-Sentence Definition

The Rho Index measures the degree to which asset or portfolio returns are associated with changes in interest rates over a defined period.

What It Measures

- Interest-rate sensitivity: how returns tend to move as rates rise or fall.

- Directional exposure: whether rate changes historically correspond to positive or negative performance.

- Strength of relationship: the magnitude and stability of the rate–return association.

Where It’s Used

- Portfolio analysis: assessing rate exposure across asset classes.

- Macroeconomic research: studying market response to monetary policy shifts.

- Risk management: identifying sensitivity to tightening or easing cycles.

- Benchmarking: comparing interest-rate dependence across time or strategies.

Why an Index Matters

Interest rates affect many assets indirectly and with varying lag. A standardized index provides a shared reference for describing that sensitivity, improving clarity when comparing results across periods, portfolios, or studies.

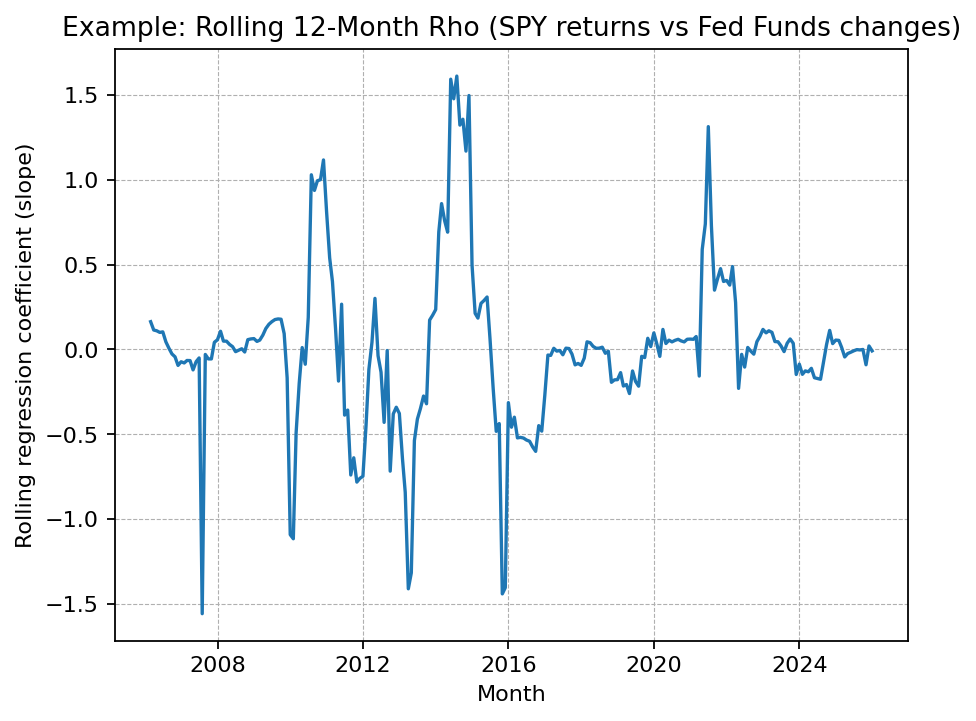

Example: Rolling 12-Month Rho

Chart updated daily using public data sources.

Scope & Terminology Note

“Rho” is used in multiple disciplines, including statistics and options pricing. This page refers specifically to a rate-sensitivity index concept, not any proprietary product, formula, or trading signal.